Forex trading, also known as foreign exchange trading or FX trading, is the process of buying and selling currencies in the foreign exchange market with the aim of making a profit. It is one of the largest and most liquid financial markets globally, with a daily trading volume exceeding $6 trillion. In this comprehensive beginner's guide, we will explore the fundamentals of Forex trading, including how it works, key participants, trading strategies, and essential tips for those looking to embark on their journey into this dynamic and potentially lucrative market.

Understanding Forex Trading

1. Currency Pairs:

At the core of Forex trading are currency pairs. Currencies are traded in pairs, where one currency is exchanged for another. Each pair consists of two currencies: a base currency and a quote currency. For instance, in the EUR/USD pair, the Euro (EUR) is the base currency, and the US Dollar (USD) is the quote currency.

2. Exchange Rates:

Exchange rates represent the relative value of one currency compared to another. They determine how much of the quote currency is needed to purchase one unit of the base currency. For example, if the EUR/USD exchange rate is 1.20, it means one Euro can be exchanged for 1.20 US Dollars.

3. Market Participants:

Several key players participate in the Forex market:

Banks and Financial Institutions: These entities facilitate currency transactions for clients, manage their own trading positions, and engage in speculative trading.

Corporations: Companies involved in international trade use Forex to hedge currency risk, ensuring they can buy and sell goods at predictable prices.

Retail Traders: Individual traders participate in Forex through online brokers, making it accessible to anyone with an internet connection.

Central Banks: Central banks play a significant role in the Forex market by managing a country's monetary policy and occasionally intervening in the market to stabilize their currency's exchange rate.

How Does Forex Trading Work?

Forex trading revolves around the concept of buying one currency while simultaneously selling another. Here's how it works:

Currency Pair Selection: Traders select a currency pair based on their analysis and expectations. They decide whether to buy (go long) or sell (go short) the base currency.

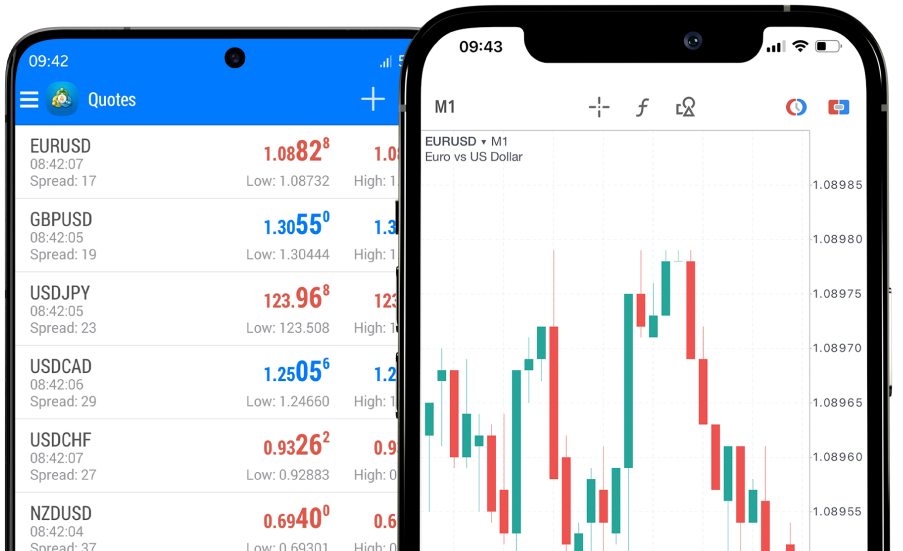

Placing a Trade: Traders execute their chosen trade through a Forex broker's trading platform. They specify the amount of the base currency they want to buy or sell.

Leverage: Forex brokers often offer leverage, allowing traders to control a more substantial position size than their initial capital. Leverage can amplify both profits and losses.

Monitoring and Closing Trades: Traders closely monitor their positions as the market moves. They can set "stop-loss" and "take-profit" orders to manage risk and secure profits. When they are satisfied with the trade's outcome, they close it.

Profit or Loss: The difference between the entry and exit prices determines the trader's profit or loss. If the price moved in their favor, they make a profit; if it moved against them, they incur a loss.

Forex Trading Strategies

Successful Forex trading often involves the use of various strategies and analysis techniques. Here are some commonly employed approaches:

Technical Analysis: Traders analyze historical price charts, patterns, and technical indicators to predict future price movements.

Fundamental Analysis: This approach involves assessing economic and geopolitical factors that could influence exchange rates, such as interest rates, economic data, and political events.

Sentiment Analysis: Traders gauge market sentiment and investor psychology by monitoring news, social media, and market sentiment indicators.

Scalping, Day Trading, and Swing Trading: These strategies differ in terms of trading frequency. Scalpers aim for tiny, short-term gains, day traders make multiple trades within a day, and swing traders hold positions for several days or weeks.

Risk Management: Effective risk management is crucial. Traders use strategies like setting stop-loss orders, diversifying their portfolio, and avoiding over-leveraging to protect their capital.

Key Considerations for Forex Traders

If you're considering entering the world of Forex trading, here are some essential considerations:

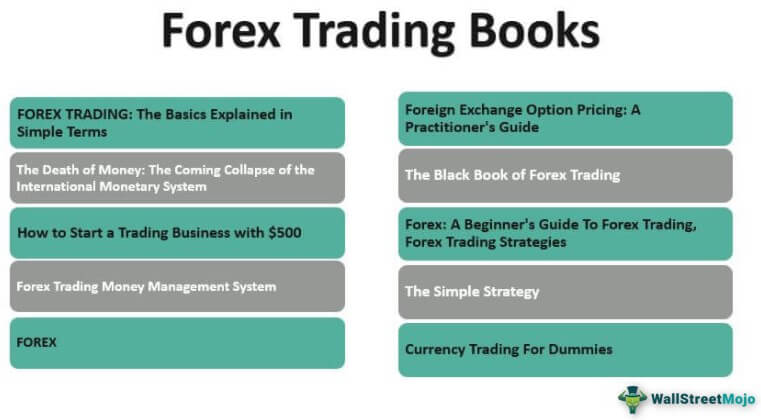

Education: Take the time to educate yourself about the Forex market. There are numerous online courses, books, and resources available to help you understand the fundamentals.

Demo Trading: Practice with a demo account provided by your broker to get a feel for the market without risking real money. It's an excellent way to hone your skills and test different strategies.

Risk Management: Never risk more than you can afford to lose. Develop a risk management plan and stick to it.

Emotional Control: Emotions like greed and fear can cloud judgment. Maintain emotional discipline and avoid making impulsive decisions.

Continuous Learning: The Forex market is dynamic, and learning never stops. Stay updated with market news, trends, and trading techniques.

Conclusion

Forex trading offers an exciting opportunity for individuals to participate in the world's largest financial market. While it can be highly profitable, it's essential to approach it with knowledge, discipline, and a well-defined trading strategy. Whether you're a beginner or an experienced trader, continuous learning and prudent risk management are the keys to success in Forex trading. As you embark on your trading journey, remember that practice, patience, and a deep understanding of the market are your greatest allies in the quest for trading proficiency.