Demo trading accounts, often referred to as "paper trading" or "virtual trading" accounts, are a valuable tool for traders, both beginners and experienced ones. They serve as a risk-free environment for individuals to practice and hone their trading skills without risking real capital. In this comprehensive guide, we will explore how demo trading accounts work, their benefits, limitations, and how to make the most of them on your journey to becoming a successful trader.

Understanding Demo Trading Accounts

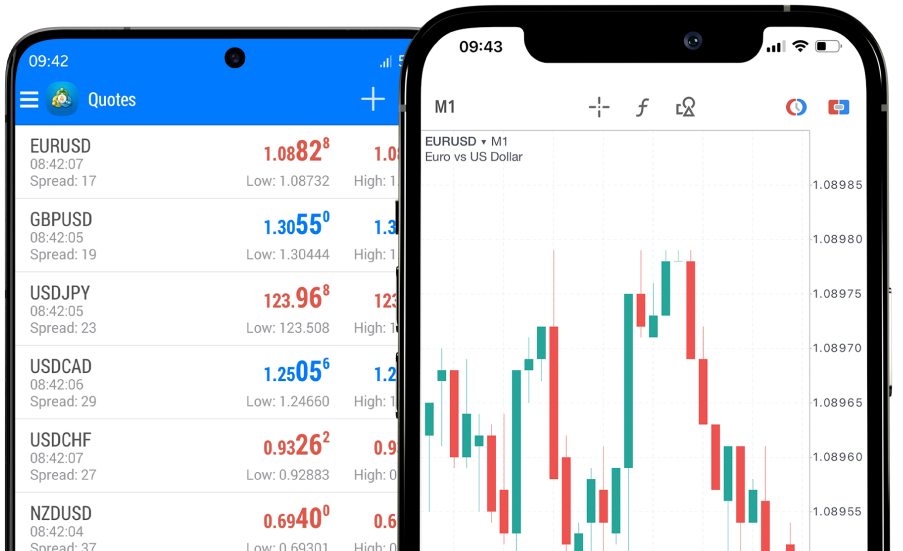

A demo trading account is a simulated trading platform provided by brokers to allow traders to experience the financial markets without using real money. These accounts replicate the live trading environment, providing access to real-time market data, charts, and trading tools. The key features of demo trading accounts include:

Simulated Funds: Traders are given a virtual balance of funds to use for trading. These funds have no real value and cannot be withdrawn.

Real Market Conditions: Demo accounts mirror actual market conditions, including live price quotes, order execution, and market volatility.

Access to Trading Instruments: Traders can typically trade a wide range of financial instruments, including stocks, currencies, commodities, and indices, just like they would on a live account.

Risk-Free: Since no real money is involved, losses incurred while using a demo account do not have any financial consequences.

How Do Demo Trading Accounts Work?

Demo trading accounts work by replicating the live trading environment as closely as possible. Here's a step-by-step overview of how they operate:

1. Account Creation:

Traders interested in using a demo account must sign up with a broker that offers this service. Most brokers offer both live and demo accounts, making it easy to switch between the two.

2. Virtual Funds:

Upon registration, traders receive a virtual balance of funds, which can vary in amount depending on the broker. This virtual balance simulates the trading capital available for use in the demo account.

3. Trading Platform Access:

Traders can access the broker's trading platform, which is identical to the one used for live trading. This platform provides access to various trading instruments, real-time charts, technical analysis tools, and order execution features.

4. Placing Trades:

Traders can place trades just as they would on a live account. They can buy or sell assets, set stop-loss and take-profit orders, and use various trading strategies.

5. Monitoring and Analysis:

Demo traders can monitor their open positions, track account balances, and use technical and fundamental analysis tools to make trading decisions.

6. Market Experience:

The demo account allows traders to gain experience and practice trading strategies in a risk-free environment. They can observe how the market reacts to news events and economic data releases.

7. Learning Opportunities:

Demo trading accounts are excellent learning tools. Traders can test their trading skills, develop new strategies, and learn from their mistakes without any financial repercussions.

8. Transition to Live Trading:

Once traders feel confident in their abilities and have a profitable track record on their demo account, they can transition to live trading by opening a real account with the same broker.

Benefits of Demo Trading Accounts

Demo trading accounts offer several benefits to traders:

Risk-Free Practice: The absence of real money means traders can practice without fear of losing capital, making it an ideal environment for beginners.

Market Familiarization: Traders can become comfortable with the trading platform and various trading instruments, gaining a better understanding of the markets.

Strategy Testing: Traders can test different trading strategies, refine them, and determine which ones work best for their trading style.

Psychological Preparation: Demo trading helps traders develop emotional discipline and learn to manage emotions like fear and greed.

Technical Proficiency: Traders can become proficient in using technical analysis tools and charts for better decision-making.

Limitations of Demo Trading Accounts

While demo trading accounts offer numerous advantages, they also have limitations:

Lack of Emotional Impact: The absence of real money can result in different psychological reactions compared to live trading. Traders may not experience the same emotions when virtual funds are at stake.

Execution Differences: Order execution on a demo account may not always replicate real market conditions, particularly during periods of high volatility or with certain brokers.

No Slippage: Traders may not experience slippage, a common occurrence in live trading where orders are executed at a different price than expected.

Overconfidence: Some traders may become overconfident after successful demo trading, believing that similar results will be achieved in live trading.

Making the Most of Demo Trading Accounts

To maximize the benefits of demo trading accounts, here are some tips:

Treat it Seriously: Approach demo trading as if it were real money. Trade with discipline, stick to your strategy, and avoid taking unnecessary risks.

Set Realistic Goals: Establish clear objectives and trading goals for your demo account. This helps you measure your progress and performance.

Keep a Trading Journal: Maintain a journal to record your trades, strategies, and the reasons behind your decisions. This can help you analyze and improve your trading.

Experiment and Learn: Use the demo account to experiment with different trading strategies, indicators, and timeframes to find what suits you best.

Transition to Live Trading: Once you're consistently profitable on your demo account and have developed emotional discipline, consider transitioning to live trading with a modest amount of capital.

Conclusion

Demo trading accounts are invaluable tools for traders of all levels, offering a risk-free environment to practice and learn. By understanding how demo accounts work and using them effectively, traders can enhance their skills, develop strategies, and gain the confidence needed for successful trading in the real financial markets. Remember that while demo trading can be an excellent learning experience, the transition to live trading may still present its challenges, so continuous learning and adaptability remain essential for long-term trading success.