Forex trading platforms are the backbone of the foreign exchange (Forex or FX) market, facilitating the buying and selling of currencies by traders and investors worldwide. These platforms are software applications that connect traders to the interbank Forex market, where currencies are traded. In this comprehensive guide, we will explore what Forex trading platforms are, how they work, and the key features that make them essential tools for participants in the Forex market.

Understanding Forex Trading Platforms

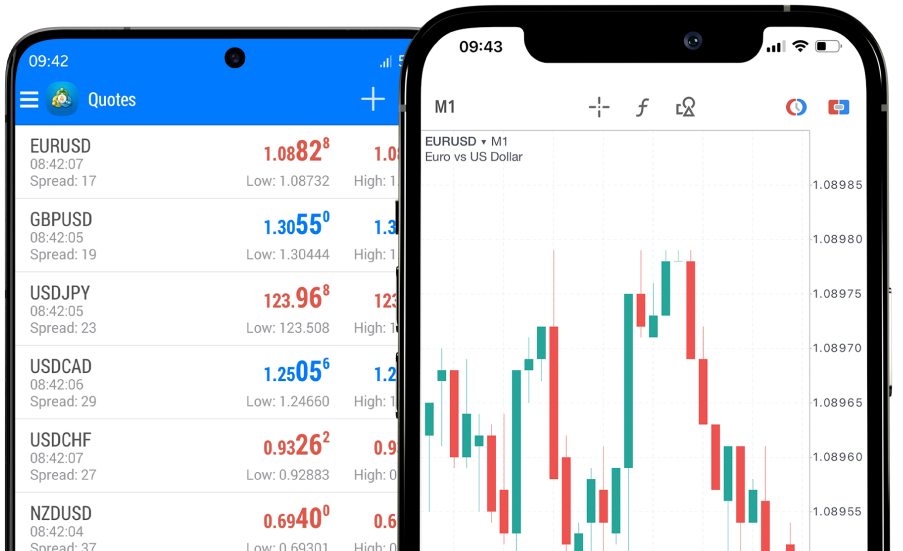

A Forex trading platform serves as an intermediary between traders and the global Forex market. It provides access to real-time currency quotes, charts, technical analysis tools, order execution capabilities, and other essential features that enable traders to analyze, place, and manage their trades. These platforms are available in various forms, including desktop applications, web-based platforms, and mobile apps, catering to traders' preferences and needs.

How Forex Trading Platforms Work

1. Connecting to Liquidity Providers

Forex brokers, who act as intermediaries between retail traders and the interbank Forex market, use trading platforms to connect to liquidity providers such as banks and financial institutions. These liquidity providers supply the actual bid and ask prices for currency pairs.

2. Providing Real-Time Market Data

Forex trading platforms continuously receive real-time market data, including currency pair prices, trading volume, and order book information. This data is essential for traders to make informed decisions and execute trades.

3. Analyzing the Market

Trading platforms offer a wide range of tools for technical and fundamental analysis. Traders can access historical price charts, indicators, drawing tools, and economic calendars to assess market trends and identify potential trade opportunities.

4. Placing Orders

Traders can use Forex trading platforms to place various types of orders, including market orders, limit orders, and stop-loss orders. These orders specify the desired entry and exit points for trades.

5. Executing Trades

Once a trader places an order through the platform, the broker's system sends the order to the liquidity provider offering the best available price. The order is then executed, and the trade is recorded in the trader's account.

6. Managing Positions

Trading platforms enable traders to monitor their open positions, account balances, and margin levels in real-time. They can also modify or close positions as market conditions change.

7. Risk Management

Platforms offer risk management tools like stop-loss and take-profit orders, allowing traders to limit potential losses and secure profits automatically.

8. Mobile Trading

Many Forex trading platforms provide mobile apps, enabling traders to trade from smartphones and tablets. Mobile trading offers flexibility and allows traders to stay connected to the market while on the go.

Key Features of Forex Trading Platforms

Forex trading platforms offer a wide range of features to meet the diverse needs of traders. Some of the key features include:

1. User-Friendly Interface

Platforms are designed with user-friendly interfaces to accommodate traders of all levels, from beginners to professionals.

2. Charting and Technical Analysis Tools

Advanced charting tools and technical analysis indicators help traders make informed decisions based on price patterns and trends.

3. News and Analysis

Many platforms provide access to real-time news feeds and market analysis from financial experts, helping traders stay informed about economic events that may impact the Forex market.

4. Multiple Timeframes

Traders can analyze price data on different timeframes, from seconds to months, to gain insights into short-term and long-term trends.

5. Order Types

Forex trading platforms offer various order types, including market orders, limit orders, stop orders, and trailing stop orders, giving traders flexibility in executing their strategies.

6. Customization

Traders can customize their trading platforms by adding or removing features, indicators, and tools to suit their preferences.

7. Security and Encryption

Platform providers prioritize security, employing encryption and authentication measures to protect users' personal and financial information.

Popular Forex Trading Platforms

Several Forex trading platforms are widely used by traders and investors worldwide. Some of the most popular ones include:

1. MetaTrader 4 (MT4)

MT4 is known for its user-friendly interface, extensive charting capabilities, and support for automated trading through Expert Advisors (EAs).

2. MetaTrader 5 (MT5)

MT5 offers advanced features, including more timeframes, additional technical indicators, and an economic calendar, making it suitable for professional traders.

3. cTrader

cTrader is favored for its transparency, one-click trading, and level II pricing, providing a professional trading environment.

4. TradingView

TradingView is a web-based platform known for its powerful charting and social networking features, allowing traders to share ideas and strategies.

5. NinjaTrader

NinjaTrader is popular among futures traders and offers advanced charting, analysis tools, and support for automated trading strategies.

Conclusion

Forex trading platforms play a pivotal role in the world of currency trading, connecting traders to the global Forex market and providing them with the necessary tools to analyze, execute, and manage trades. These platforms are designed to accommodate traders of all levels, from beginners to experienced professionals, offering a range of features to enhance the trading experience.

As technology continues to advance, Forex trading platforms evolve to provide even more sophisticated tools and capabilities. Traders should carefully evaluate and choose the platform that best aligns with their trading style, objectives, and preferences to maximize their success in the dynamic and ever-changing Forex market.