In the ever-evolving world of online forex trading, IC Markets has consistently positioned itself as a leading broker, catering to both novice and experienced traders globally. This comprehensive review for 2024 will delve into the facets that set IC Markets apart, including its trading platforms, account types, customer service, regulatory compliance, and overall trading experience. Our goal is to provide you with an unbiased overview to help you determine if IC Markets aligns with your trading needs and aspirations.

Company Background

Established in 2007 in Sydney, Australia, IC Markets sought to bridge the gap between retail and institutional traders, offering access to investment opportunities previously available only to investment banks and high net worth individuals. Over the years, it has grown into one of the largest forex CFD providers worldwide, based on trading volume.

Regulatory Compliance and Security

A paramount concern for every trader is the security of their funds and the regulatory framework within which a broker operates. IC Markets ticks the box in this crucial aspect by being regulated by several reputable financial authorities, including the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the Seychelles Financial Services Authority (FSA). These regulatory bodies ensure that IC Markets adheres to stringent standards of operation, offering traders peace of mind regarding the safety of their investments.

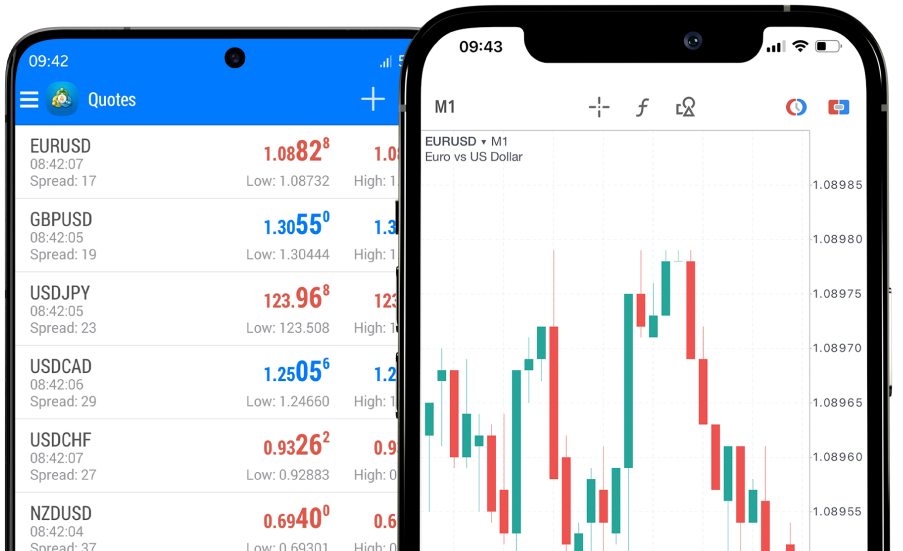

Trading Platforms and Tools

IC Markets offers a choice between three of the most powerful and popular trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Each platform comes with its unique set of tools and features, catering to different trading styles and preferences. For instance, MT4 is renowned for its automation capabilities, MT5 for its advanced financial trading functions, and cTrader for its sophisticated interface and depth of market display.

Beyond the platforms themselves, IC Markets excels in providing a plethora of trading tools, including advanced charting capabilities, one-click trading, a variety of technical indicators, and access to a deep pool of liquidity providers. This ensures tight spreads and best prices for traders.

Account Types

Understanding that traders have varying needs, IC Markets offers three main account types: Standard, Raw Spread, and cTrader Raw. The Standard account is commission-free, offering spreads from just 1 pip, making it suitable for novice traders. Conversely, the Raw Spread and cTrader Raw accounts cater to more experienced traders, providing spreads from 0.0 pips with a commission per trade. This flexibility allows traders to choose an account that best fits their trading strategy and cost considerations.

Customer Support

A vital component of a broker's offering is its customer support. IC Markets understands this and provides 24/7 support via live chat, email, and phone. Their team is knowledgeable and ready to assist with any queries or issues, ensuring a smooth trading experience for clients around the globe.

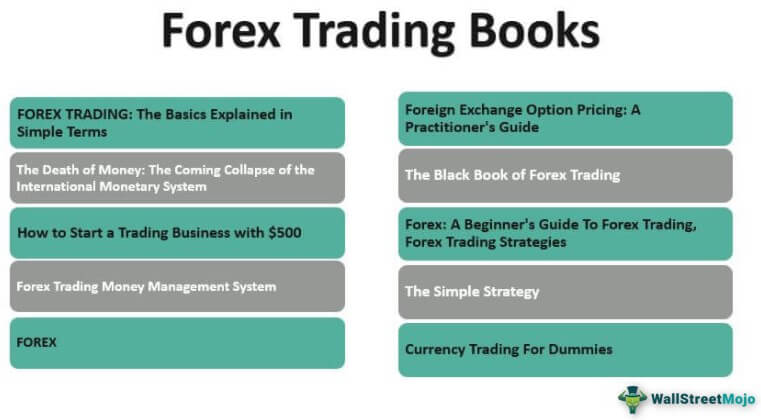

Educational Resources and Market Analysis

IC Markets is committed to empowering traders through education. It offers an extensive range of educational resources, including webinars, tutorials, articles, and market analysis. This content is designed to help traders at all levels enhance their trading skills and knowledge, from understanding the basics to mastering advanced strategies.

Conclusion

In summary, IC Markets presents a compelling choice for forex traders in 2024, thanks to its robust regulatory compliance, a wide range of trading platforms and tools, flexible account types, and exceptional customer support. Whether you're a beginner or a seasoned trader, IC Markets provides a conducive environment for trading success. As the forex market continues to grow, choosing a reliable and reputable broker like IC Markets could be a pivotal step in your trading journey.