In the vast sea of Forex and CFD brokers, choosing the right platform can be a daunting task for traders. Among the plethora of options, IC Markets and FXPrimus stand out as two prominent names, each with its unique strengths and offerings. This detailed exploration aims to dissect and compare these two brokers across various dimensions such as trading conditions, platforms, regulatory frameworks, customer support, and educational resources, providing traders with the insights needed to make an informed decision.

Introduction to IC Markets and FXPrimus

IC Markets is renowned for its exceptional trading conditions, including low spreads, high leverage, and superior execution speeds. Based in Australia, it has grown to become one of the largest brokers globally, attracting both retail and institutional traders. Its commitment to providing a transparent and reliable trading environment is evident through its regulation by several top-tier financial authorities.

FXPrimus, on the other hand, is known for its strong emphasis on trader education and safety. Established with the goal of setting a new standard for online trading platforms, FXPrimus offers a secure trading environment with additional features like insurance on deposits. It operates under strict regulatory standards, ensuring a high level of protection for its clients' funds.

Trading Conditions

When comparing the trading conditions of IC Markets and FXPrimus, several factors come into play, including spreads, leverage, and execution speed.

Spreads: IC Markets is widely recognized for its low spreads, starting from 0.0 pips on major currency pairs. This is particularly beneficial for scalpers and high-volume traders. FXPrimus, while competitive, tends to have slightly higher spreads, but it compensates with other features like free VPS and personal account managers for some account types.

Leverage: Both brokers offer high leverage options, but IC Markets provides up to 1:500 for certain instruments, which is attractive for traders looking to maximize their trading potential. FXPrimus offers leverage up to 1:500 as well, but with stricter conditions and on a select range of instruments.

Execution Speed: IC Markets excels with its superior execution speeds, thanks to its investment in technology and infrastructure, reducing the likelihood of slippage. FXPrimus also boasts fast execution speeds, though IC Markets has a slight edge in this area.

Trading Platforms

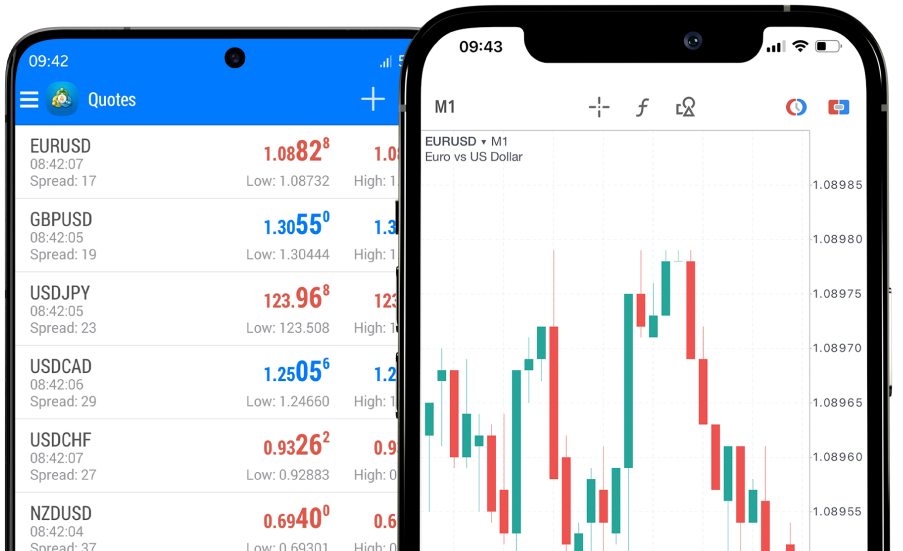

Both IC Markets and FXPrimus support the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, offering traders a familiar and robust trading environment. Additionally, IC Markets provides access to the cTrader platform, which is favored by many traders for its advanced charting tools and algorithmic trading capabilities. The choice between these platforms often comes down to personal preference, but the option to use cTrader is a notable advantage for IC Markets.

Regulatory Framework and Safety of Funds

Regulation is a critical factor in assessing the reliability and integrity of a broker. IC Markets is regulated by reputable authorities, including the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the Seychelles Financial Services Authority (FSA). FXPrimus is also well-regulated, with oversight from CySEC and the Vanuatu Financial Services Commission (VFSC), and it goes a step further by offering an insurance policy to protect clients' funds, which is a unique feature not found in many brokers.

Customer Support and Educational Resources

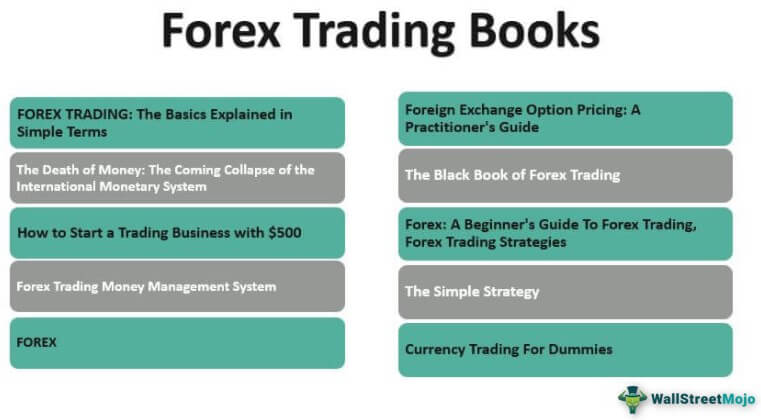

Customer support and educational resources are essential for both new and experienced traders. FXPrimus shines in this area with a comprehensive range of educational materials, including webinars, e-books, and trading videos. It also offers excellent customer service with fast response times. IC Markets, while providing quality educational content and support, focuses more on offering advanced trading tools and resources for experienced traders.

Conclusion

Deciding whether IC Markets is better than FXPrimus depends on the individual trader's needs and priorities. IC Markets offers superior trading conditions with lower spreads, higher leverage, and faster execution, making it an excellent choice for scalpers and high-volume traders. On the other hand, FXPrimus provides a secure trading environment with unique features like deposit insurance and a strong emphasis on education and customer support, catering well to beginners and those who prioritize safety and learning.

Ultimately, both brokers have their merits, and the choice between them should be based on personal trading strategies, priorities, and preferences. Traders are encouraged to conduct their own research and consider demo trading with both brokers before making a final decision.