In the diverse world of online forex trading, BDSwiss has emerged as a significant player, particularly in the South African market. This article provides a detailed review of BDSwiss, focusing on its pros and cons as they relate to both novice and experienced forex traders. Through reliable data, industry trends, and comprehensive analysis, this review aims to equip traders with the necessary information to make informed decisions.

Introduction

BDSwiss, established in 2012, has expanded its reach globally with a strong presence in South Africa. Known for its robust platform and comprehensive trading services, BDSwiss caters to a wide range of traders. This review assesses the strengths and weaknesses of BDSwiss, exploring how they align with the needs of traders in today’s dynamic market environment.

Pros of Trading with BDSwiss

Regulatory Compliance and Security

Regulation: BDSwiss is regulated by CySEC and registered with multiple financial authorities globally, ensuring a high standard of accountability and transparency.

Security Measures: It employs advanced security protocols to protect user data and funds, which is crucial for trader confidence.

Trading Platform and Tools

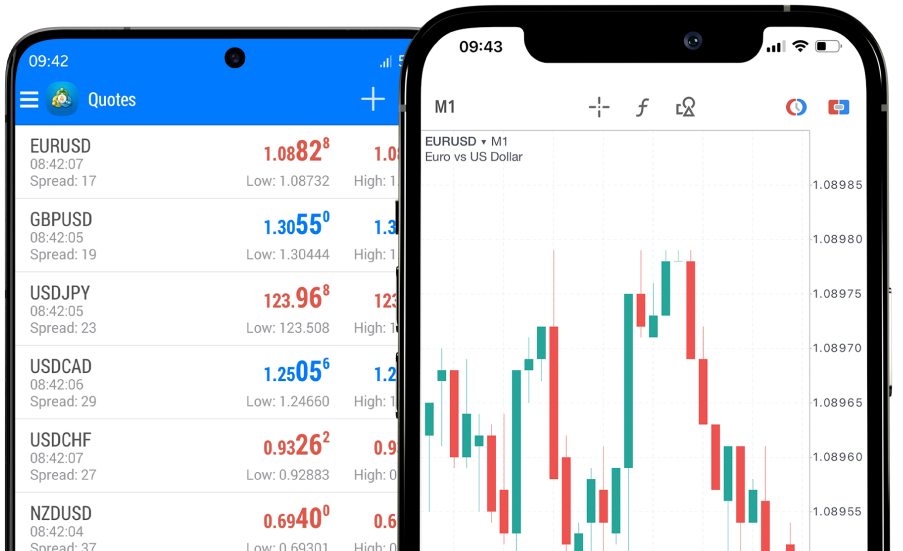

Platforms Offered: BDSwiss provides access to both MetaTrader 4 and MetaTrader 5, allowing traders to use advanced analytical tools and features.

Educational Resources: A wealth of educational materials and webinars are available, which is beneficial for beginners and experienced traders looking to refine their strategies.

Customer Support

Local Availability: Customer support is tailored for the South African market with localized services and support in multiple languages, enhancing user experience.

Cons of Trading with BDSwiss

Cost Structure

Trading Costs: Some users have reported that the trading costs, particularly the spreads on certain asset classes, can be higher than some competitors.

Withdrawal Fees: There are fees associated with bank wire withdrawals, which could be a downside for small volume traders.

Limited Product Range

Focus on Forex: While BDSwiss offers a variety of trading instruments, its focus remains heavily on forex, potentially limiting options for those looking to trade a broader range of assets.

Industry Trends and User Feedback

The forex trading landscape is notably influenced by technological advancements and regulatory changes. BDSwiss has kept pace with these trends by continually upgrading its service offerings and maintaining stringent regulatory standards. User feedback generally highlights the platform’s user-friendly nature and educational support, though some have pointed out the need for more competitive pricing structures.

Data and Case Studies

Recent statistics indicate that the demand for forex trading in South Africa is growing, with an increasing number of traders looking for reliable and well-regulated brokers. BDSwiss, with its strong regulatory framework and comprehensive trading tools, aligns well with these needs.

Conclusion

BDSwiss offers a solid option for South African traders, characterized by robust educational resources, reliable customer support, and a strong emphasis on security. However, potential traders should also consider the relatively higher costs and the focus on forex trading when choosing BDSwiss as their broker. Overall, BDSwiss stands out as a reputable platform in the competitive forex trading market.