The world of Forex trading in Kenya has experienced significant growth in recent years. With the increasing interest in currency trading, the demand for reliable Forex brokers has also surged. Traders often wonder, "Which is the best Forex broker in Kenya?" In this in-depth guide, we will explore the factors that make a Forex broker the best choice for Kenyan traders and provide a list of top contenders in 2024.

Understanding the Importance of Choosing the Right Forex Broker

Selecting the best Forex broker is a crucial decision that can greatly influence your trading success. The Forex broker you choose acts as your gateway to the global currency market. Here are some key reasons why choosing the right broker matters:

1. Regulation and Security

A reputable Forex broker should be regulated by a recognized financial authority. Regulatory oversight provides a level of security and ensures that the broker adheres to strict financial standards and ethical practices.

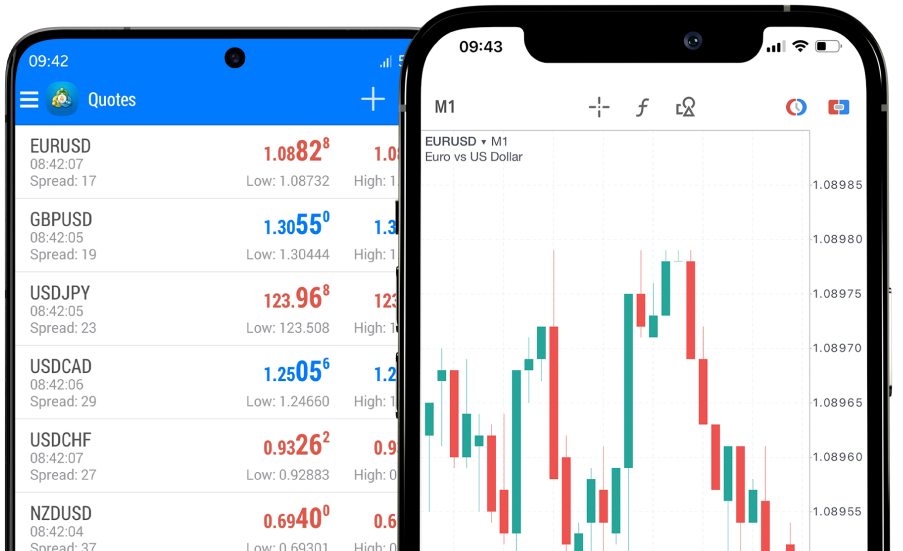

2. Trading Platforms and Tools

The trading platform offered by a broker is your primary tool for executing trades. A good broker should provide a user-friendly, reliable, and feature-rich trading platform, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

3. Spreads and Commissions

Competitive spreads and transparent commission structures can significantly impact your trading costs and potential profitability.

4. Customer Support

Responsive and efficient customer support is essential for addressing any issues or inquiries you may have while trading.

5. Payment Options

The availability of convenient and secure payment methods, including local options in Kenya, simplifies deposits and withdrawals.

6. Educational Resources

For both novice and experienced traders, access to educational materials and resources can help improve trading skills and knowledge.

7. Trading Instruments

A diverse range of currency pairs and other trading instruments allows you to diversify your trading portfolio.

8. Leverage

While leverage can amplify profits, it also increases risk. A good broker provides appropriate leverage options while emphasizing responsible trading.

Top Forex Brokers for Kenyan Traders in 2024

Now that we understand the criteria for selecting the best Forex broker, let's explore some of the top contenders for Kenyan traders in 2024:

1. XM Group

Regulation: CySEC, FCA

Trading Platforms: MT4, MT5

Min. Deposit: $5

Leverage: Up to 1:888

Key Features: Competitive spreads, educational resources, and excellent customer support.

2. HotForex

Regulation: FCA, CySEC

Trading Platforms: MT4, MT5

Min. Deposit: $5

Leverage: Up to 1:1000

Key Features: A wide range of trading instruments, multiple account types, and educational materials.

3. FXTM (FXTM)

Regulation: FCA, CySEC

Trading Platforms: MT4, MT5

Min. Deposit: $10

Leverage: Up to 1:1000

Key Features: Copy trading, extensive educational resources, and low spreads.

4. OctaFX

Regulation: CySEC

Trading Platforms: MT4, MT5

Min. Deposit: $5

Leverage: Up to 1:500

Key Features: Low spreads, various account types, and a user-friendly platform.

5. Exness

Regulation: FCA, CySEC

Trading Platforms: MT4, MT5

Min. Deposit: $1

Leverage: Up to 1:Unlimited

Key Features: Low minimum deposit, tight spreads, and a range of account types.

6. Pepperstone

Regulation: FCA, ASIC, DFSA

Trading Platforms: MT4, MT5

Min. Deposit: $200

Leverage: Up to 1:500

Key Features: Low spreads, excellent customer support, and a variety of trading tools.

7. IC Markets

Regulation: ASIC, CySEC

Trading Platforms: MT4, MT5

Min. Deposit: $200

Leverage: Up to 1:500

Key Features: Competitive spreads, fast execution, and a wide range of assets.

8. IG Group

Regulation: FCA, ASIC, CFTC

Trading Platforms: IG Trading Platform

Min. Deposit: $300

Leverage: Up to 1:50

Key Features: Comprehensive research tools and a user-friendly platform.

Conclusion: The Best Forex Broker for You

The best Forex broker for you ultimately depends on your individual trading preferences and requirements. While the brokers listed above are reputable and offer a range of features, it's essential to conduct thorough research, assess your trading goals, and consider your risk tolerance before making a decision.

Kenyan traders should prioritize choosing a regulated broker that provides a secure trading environment. Additionally, consider factors such as trading platforms, spreads, customer support, and available educational resources to align with your trading strategy.

Remember that successful Forex trading requires continuous learning and practice. By selecting the right Forex broker and investing time in improving your skills, you can navigate the dynamic Forex market with confidence and potentially achieve your trading goals.