In the dynamic world of online trading, choosing the right broker is crucial for both novice and experienced traders. Global Prime, a well-regarded brokerage firm in the forex and CFD trading community, has garnered attention for its transparent trading environment and client-focused services. This article aims to dissect the advantages and disadvantages of trading with Global Prime, providing insights to help traders make informed decisions. By examining various aspects such as regulatory compliance, trading platforms, account types, customer service, and trading costs, we'll delve into what sets Global Prime apart in the competitive brokerage landscape and where it might fall short for some traders.

Pros of Global Prime

Regulatory Compliance and Security

Global Prime operates under strict regulatory oversight, ensuring a high level of security and transparency. Regulated by reputable financial authorities, Global Prime offers traders peace of mind, knowing their investments are with a broker that adheres to stringent regulations designed to protect client interests.

Transparent Trading Environment

One of the standout features of Global Prime is its commitment to providing a transparent trading environment. The broker offers trade receipt functionality that allows traders to see the liquidity provider for each trade, ensuring transparency and fairness in order execution.

Advanced Trading Platforms

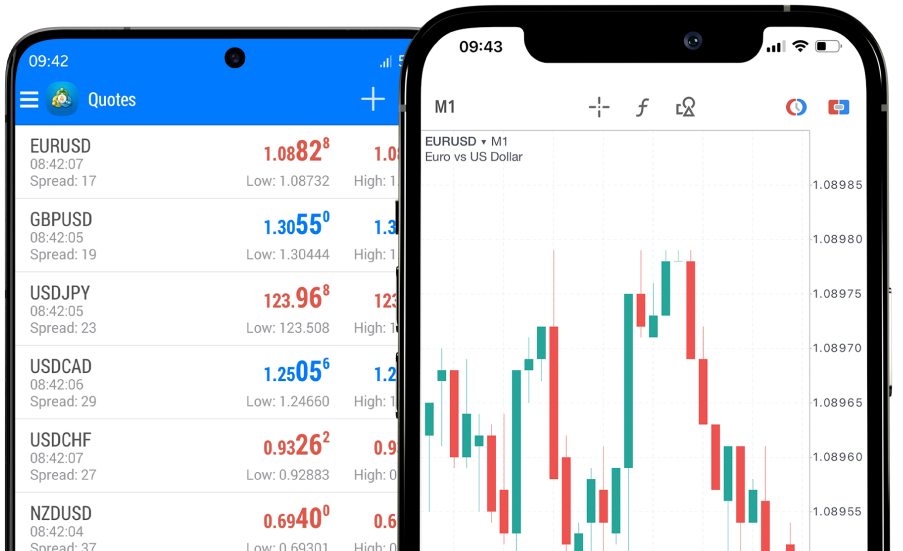

Global Prime provides access to advanced trading platforms, including MetaTrader 4 (MT4), TraderEvolution, and a robust API for algorithmic traders. These platforms cater to the needs of both manual and automated traders, offering a range of tools and features for technical analysis, risk management, and trade execution.

Exceptional Customer Service

Customer service is a critical component of a broker's offering, and Global Prime excels in this area. The broker provides responsive, knowledgeable, and friendly support, ensuring traders receive timely assistance and guidance on various trading-related issues.

Competitive Trading Costs

Global Prime offers competitive trading costs, with tight spreads and low commission rates. This cost efficiency is particularly beneficial for high-volume traders and those employing scalping strategies, as it can significantly impact overall profitability.

Cons of Global Prime

Limited Asset Coverage

Compared to some competitors, Global Prime offers a relatively limited range of tradable assets. While it covers major forex pairs, metals, and some CFDs, traders looking for a broad selection of stocks, commodities, or cryptocurrencies might find the offerings insufficient.

MetaTrader 4 Focus

While Global Prime does offer other platforms like TraderEvolution and its API, the primary focus on MetaTrader 4 might not appeal to traders seeking more modern or different trading platforms. MT4, although highly popular and versatile, may not satisfy all traders' needs, especially those looking for advanced features available in newer platforms.

Geographical Restrictions

Due to regulatory and legal restrictions, Global Prime's services are not available to traders in certain countries. This limitation can be a significant drawback for traders in those regions who wish to open accounts with Global Prime.

Deposit and Withdrawal Fees

While Global Prime itself does not charge deposit or withdrawal fees, the payment processors used for transactions may impose fees. These additional costs can add up, especially for traders who make frequent deposits and withdrawals.

Educational Resources

Although Global Prime offers a solid trading environment, it may fall short in providing comprehensive educational resources for beginners. Traders new to forex and CFD trading might find the educational support insufficient compared to brokers that offer extensive training programs, webinars, and tutorials.

Conclusion

Global Prime stands out for its regulatory compliance, transparent trading practices, advanced trading platforms, exceptional customer service, and competitive trading costs. However, its limited asset coverage, focus on MT4, geographical restrictions, potential deposit and withdrawal fees, and lack of extensive educational resources could be considered drawbacks. As with any broker, it's essential for traders to weigh these pros and cons in light of their trading goals, strategies, and preferences. By doing so, traders can make a more informed decision about whether Global Prime is the right broker to partner with in their trading journey.