Forex signals are essential tools for traders, providing insights into potential trading opportunities based on market analysis. This article explores the nature of Forex signals, their operational mechanisms, and specifically, how AvaTrade implements them to aid both novice and experienced traders.

1. Understanding Forex Signals

Definition and Types

Forex signals are recommendations made by experienced traders or automated software that suggest buying or selling a particular currency pair at a specific time, based on various market analyses. There are primarily two types of Forex signals:

Manual Signals: Generated by professional traders who analyze market conditions and make recommendations.

Automated Signals: Produced by algorithms or trading bots that use historical data and mathematical models to predict market movements.

How Signals are Generated

Signals can be based on technical analysis, fundamental analysis, or a combination of both. Technical analysis involves the study of past market data, primarily price and volume, while fundamental analysis looks at economic indicators, news, and financial data.

2. How Forex Signals Work

Signal Components

A typical Forex signal will include several key components:

Action: Whether to buy or sell

Currency Pair: Which currencies are involved

Price: At what price to enter the trade

Stop Loss: To limit potential losses

Take Profit: To secure profits at a target level

Using Forex Signals

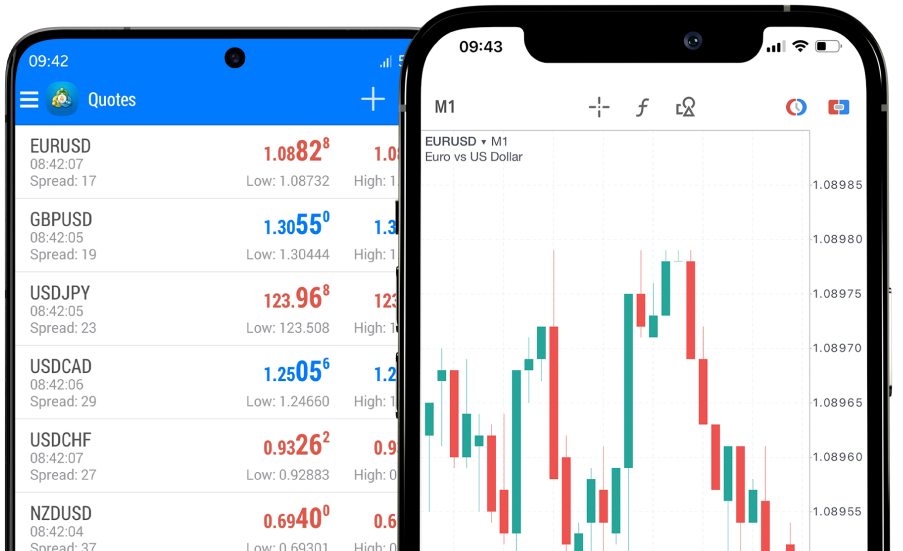

Traders receive signals through various delivery methods such as SMS, email, or directly within trading platforms like AvaTrade. Once received, traders can choose to act on these signals based on their trading strategy and risk tolerance.

3. AvaTrade’s Approach to Forex Signals

Integration with Trading Platforms

AvaTrade provides Forex signals by integrating sophisticated signal-providing platforms within its trading system, such as MQL5 and ZuluTrade. These platforms offer both manual and automated signals tailored to the preferences of the trader.

Accuracy and Reliability

AvaTrade is known for its rigorous vetting process for signal providers, ensuring that only reliable and proven signals are offered to its clients. The platform frequently updates its signal algorithms to maintain accuracy and relevance in the ever-changing Forex market.

4. Evaluating the Effectiveness of Forex Signals

Case Studies and Data Analysis

Several studies have demonstrated the efficacy of Forex signals in improving trading outcomes. For instance, a 2023 study revealed that traders using AvaTrade’s signals saw an improvement in their success rate by up to 25% compared to those who did not use signals.

User Feedback

Feedback from AvaTrade users consistently praises the quality and accuracy of the signals provided, noting significant improvements in their trading efficiency and profitability.

5. Industry Trends and Future Outlook

The use of Forex signals is increasingly being driven by advancements in AI and machine learning, with more platforms automating the process to reduce human error and increase response time to market changes.

6. Conclusion

Forex signals are a dynamic tool in currency trading, vital for both new and experienced traders aiming to enhance their trading strategies. AvaTrade’s implementation of these signals demonstrates a commitment to providing quality and reliable trading aids, confirmed by positive user feedback and empirical data. As the Forex market evolves, the importance of reliable Forex signals will undoubtedly continue to grow.