TMGM, a globally recognized forex and CFD broker, continues to stand out in 2024 with its robust offerings and competitive trading conditions. This review provides an in-depth analysis of TMGM’s features, helping traders of all experience levels understand whether this broker meets their specific needs. From platform functionality to regulatory compliance, this article highlights everything you need to know before trading with TMGM.

Regulation and Security

Regulatory Oversight

TMGM is regulated by two key authorities, the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). These regulatory bodies enforce strict standards, ensuring that TMGM complies with high levels of security and transparency.

ASIC: Highly regarded for its rigorous oversight and protection of client interests.

VFSC: Enhances regulatory reach and provides further security measures.

Client Fund Security

Segregated Accounts: TMGM keeps client funds in separate accounts to ensure they are not used for operational purposes.

Investor Compensation Scheme: Clients are eligible for compensation in the rare event of broker insolvency.

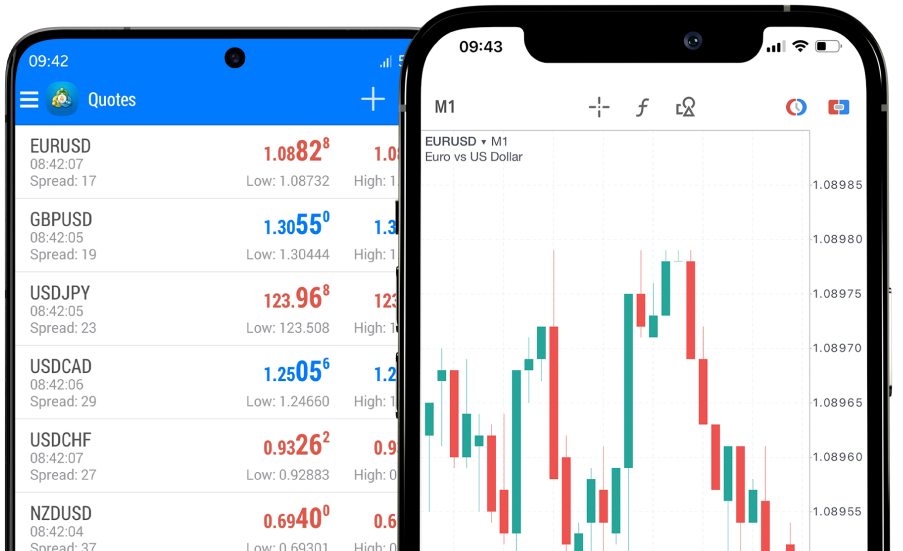

Trading Platforms

TMGM provides a suite of platforms catering to various trading needs:

MetaTrader 4 and MetaTrader 5

MT4: Renowned for its simplicity and effectiveness, MT4 remains popular due to its comprehensive technical analysis tools and automated trading features.

MT5: Offers enhanced charting tools, a more extensive range of assets, and additional order types, making it suitable for traders seeking advanced trading capabilities.

IRESS

Features: Aimed at traders focusing on share trading, IRESS provides advanced charting and real-time market data.

Customization: Allows for detailed customization of trading settings and layouts.

Account Types

TMGM offers two main account types tailored to different trading styles:

Standard Account

Spreads: Tight spreads starting from 1.0 pip.

Commission: No commission fees on forex pairs.

Minimum Deposit: $100 minimum deposit requirement.

Edge Account (ECN)

Spreads: Spreads start from 0.0 pips.

Commission: Low commissions per lot traded.

Minimum Deposit: Requires a minimum deposit of $500.

Trading Conditions and Execution

Execution Speed: TMGM boasts ultra-low latency, with an average execution speed of under 30 milliseconds.

Leverage: Offers leverage up to 1:500, providing flexibility in position sizing.

Market Range

TMGM provides an extensive range of financial markets:

Forex: Over 50 currency pairs, including majors, minors, and exotics.

CFDs: Indices, commodities, and cryptocurrencies.

Shares: More than 15,000 shares from global exchanges.

Pros and Cons of TMGM

Pros

Regulation and Security: Dual regulation ensures a secure trading environment.

Competitive Fees: Low spreads and commissions.

Wide Asset Selection: A vast range of trading instruments.

Responsive Support: 24/7 multilingual customer support.

Cons

Minimum Deposit: Higher minimum deposits required for certain accounts.

Promotional Offers: Lacks attractive promotional bonuses compared to other brokers.

User Feedback and Industry Trends

A report by Finance Magnates indicates that TMGM has consistently maintained its position among the top forex brokers, gaining traction with both beginner and experienced traders. User feedback often highlights the broker’s competitive spreads, fast execution speeds, and responsive customer support.

Conclusion

TMGM stands out as a reliable and efficient broker for 2024, with its transparent regulatory status, diverse trading platforms, and extensive market range. Although the minimum deposit might deter some new traders, its competitive spreads and trading conditions make it ideal for those serious about forex and CFD trading. Overall, TMGM provides a high-quality trading experience that is suitable for all trader levels.