TMGM (TradeMax Global Markets) is one of the prominent players in the forex and CFD trading industry, offering traders a wide range of assets and competitive trading conditions. This comprehensive review analyzes TMGM's features, platforms, regulatory compliance, and trader feedback. Whether you're a novice or an experienced trader, this article provides essential insights into evaluating TMGM as a potential broker in 2024.

Regulatory Compliance and Security

Regulation and Oversight

TMGM operates under stringent regulatory standards, being regulated by two primary bodies:

ASIC (Australian Securities and Investments Commission): TMGM's ASIC license ensures transparency and compliance with Australian regulations.

VFSC (Vanuatu Financial Services Commission): Supplementary oversight by VFSC further enhances regulatory protection.

Client Fund Safety

Segregated Accounts: Client funds are kept separate from TMGM's operational funds in segregated accounts.

Investor Compensation: Eligible clients can benefit from TMGM's compensation schemes in the event of insolvency.

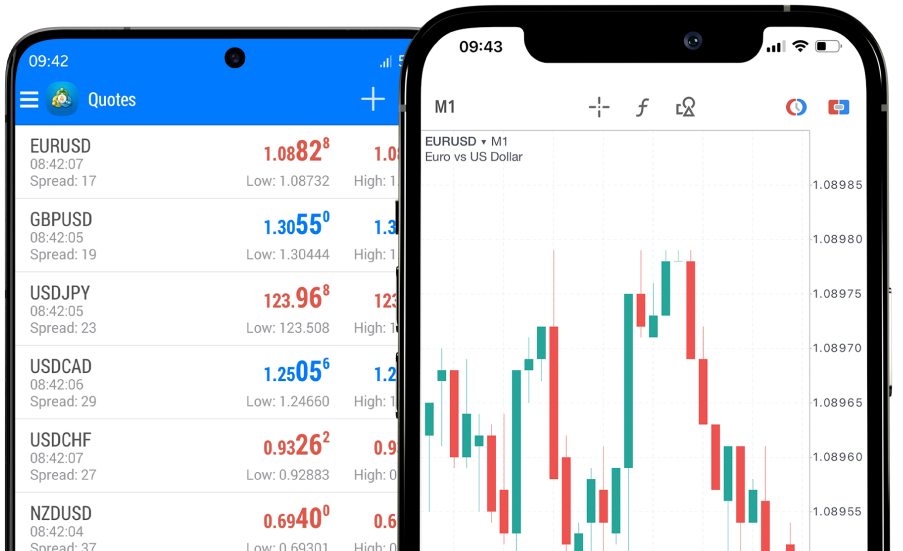

Trading Platforms

TMGM offers multiple trading platforms that cater to different trader preferences and skill levels:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

MT4: Known for its robust automated trading capabilities through Expert Advisors (EAs), MT4 also provides comprehensive charting tools.

MT5: An enhanced version of MT4, MT5 offers additional order types, timeframes, and an economic calendar.

IRESS

Features: IRESS is known for its advanced charting capabilities and access to a broad range of financial markets.

Customization: Traders can personalize their trading experience through IRESS’s flexible settings.

Account Types

TMGM provides two primary account types, each tailored to specific trader needs:

Standard Account

Spreads: Tight spreads starting from 1.0 pip.

Commission: No commission on forex trading.

Minimum Deposit: A minimum deposit of $100.

Edge (ECN) Account

Spreads: Spreads from 0.0 pips.

Commission: A low commission per lot.

Minimum Deposit: Requires a minimum deposit of $500.

Market Range

TMGM offers traders access to over 15,000 financial instruments, including:

Forex: More than 50 currency pairs, including majors, minors, and exotics.

CFDs: Indices, commodities, cryptocurrencies, and more.

Shares: A wide selection of global shares.

Trading Conditions

Execution Speed: With an average execution speed of under 30 milliseconds, TMGM is ideal for high-frequency and fast-paced trading.

Leverage: Offers leverage up to 1:500, giving traders flexibility in managing their positions.

Pros and Cons of TMGM

Pros

Regulation and Transparency: Dual regulation ensures a secure trading environment.

Trading Platforms: Offers multiple platforms suitable for different trading styles.

Market Access: Access to over 15,000 trading instruments.

Competitive Fees: Tight spreads and low commissions.

Cons

Minimum Deposit: Higher minimum deposits may discourage new traders.

Limited Bonuses: TMGM offers fewer promotional bonuses compared to some brokers.

Trader Feedback and Market Trends

Recent user feedback and market trends indicate growing interest in TMGM among both retail and professional traders. According to a report by Finance Magnates, TMGM has consistently improved its trading infrastructure and market range, making it one of the leading brokers in the industry.

Conclusion

In summary, TMGM is a well-regulated broker that offers traders a comprehensive selection of trading platforms, financial instruments, and competitive trading conditions. While the minimum deposit requirements might deter beginners, TMGM's range of features and excellent customer service ensure that experienced traders can find value in the broker's offerings.