Choosing the right Forex trading platform is a critical decision for both novice and experienced traders. In 2024, two prominent platforms that stand out are ThinkMarkets and TMGM. This article delves into a comprehensive comparison of these platforms, focusing on their features, regulatory compliance, user experience, and overall performance in the Forex market.

Platform Overview and Regulatory Compliance

ThinkMarkets

ThinkMarkets is renowned for its robust trading infrastructure and regulatory compliance. It is licensed by multiple top-tier regulators, including the FCA in the UK and ASIC in Australia, ensuring high standards of security and financial integrity. The platform offers an extensive range of trading tools and advanced charting capabilities, making it suitable for traders who require a deep analysis of the market.

TMGM

TMGM, also highly regulated by ASIC and other authorities, offers a competitive trading environment with access to over 15,000 trading instruments. Although slightly newer in the market than ThinkMarkets, TMGM has quickly established a reputation for fast execution speeds and low latency trading, which are critical for day traders and those who trade on small price movements.

Features and Trading Experience

User Interface and Usability

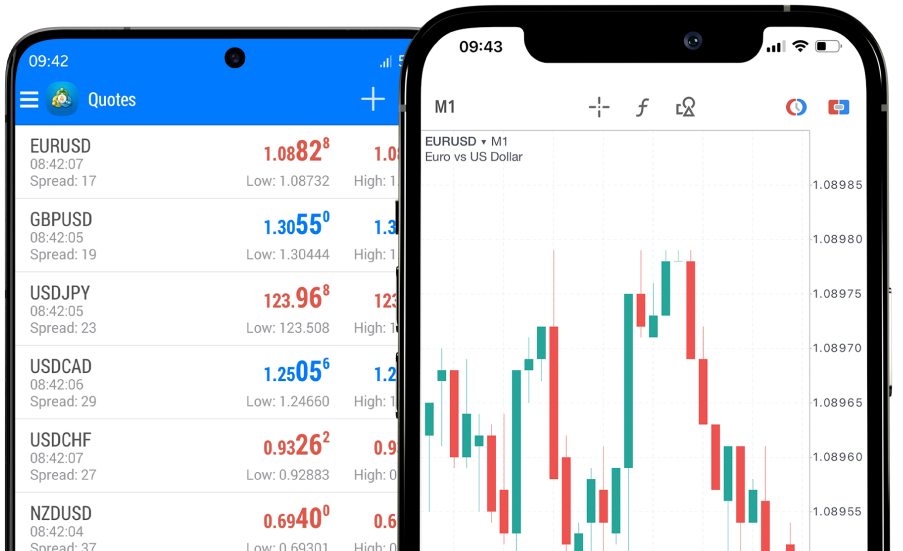

Both platforms offer user-friendly interfaces, but they cater to different types of traders. ThinkMarkets features the MetaTrader 4 and MetaTrader 5 platforms, which are favored by traders for their customizability and automated trading capabilities. TMGM offers access to MetaTrader as well as the IRESS platform, providing more options for traders depending on their trading style and preferences.

Trading Tools and Resources

ThinkMarkets excels with its advanced technical analysis tools and a comprehensive educational portal that offers webinars, eBooks, and articles to help traders improve their trading skills. TMGM, while offering fewer educational resources, compensates with innovative trading tools like Autochartist and a robust VPS service for automated trading strategies.

Market Access and Costs

Spreads and Fees

Both platforms are competitive in their fee structure, but TMGM often features lower starting spreads which can be particularly attractive for scalpers and high-volume traders. ThinkMarkets, while generally offering slightly higher spreads, includes additional features and protections that can justify the extra cost for certain traders.

Leverage and Margin Requirements

ThinkMarkets and TMGM offer high leverage options up to 500:1, but their margin requirements can vary, which is crucial for risk management. Traders need to consider their own risk tolerance and strategy when evaluating these aspects.

Customer Service and Support

Good customer support is crucial, especially for new traders. ThinkMarkets provides 24/7 customer support, which includes live chat, email, and phone services. TMGM also offers round-the-clock support, with the added benefit of multilingual support teams, which can be a significant advantage for international traders.

Industry Trends and Data Insights

According to a 2024 report by Finance Online, the Forex trading market has seen a shift towards platforms that offer both high-tech tools and user-centric features. Platforms like ThinkMarkets and TMGM are leading this trend by continually updating their systems to include faster processing times and more intuitive interfaces, which aligns with traders' evolving needs.

Conclusion

Both ThinkMarkets and TMGM offer unique advantages for Forex traders. ThinkMarkets is ideal for traders who need robust analytical tools and strong regulatory safeguards. TMGM, on the other hand, might be preferred by those who seek lower costs and a diverse range of trading instruments. Ultimately, the choice between ThinkMarkets and TMGM will depend on individual trading needs and preferences.