In the realm of Forex trading, where the waters are deep and often murky, the choice of a broker is a decision that can significantly impact the success and security of one's investment. ThinkMarkets, a name that has garnered attention in the trading community, presents itself as a promising option for those venturing into or well-versed in Forex trading. This comprehensive review seeks to examine ThinkMarkets, focusing on the quality of its services, customer feedback, product features, and scam warnings, to provide a balanced perspective for individual and institutional investors contemplating this broker.

Regulatory Compliance and Security

A cornerstone of ThinkMarkets' reputation is its strong regulatory framework. With licenses from the Australian Securities and Investments Commission (ASIC) and the UK's Financial Conduct Authority (FCA), among others, it adheres to some of the strictest standards in the industry. This compliance ensures a high level of security for investors' funds and a commitment to fair trading practices. However, as with any investment, understanding the scope and limitations of this regulatory protection is essential before making a decision.

Service Quality

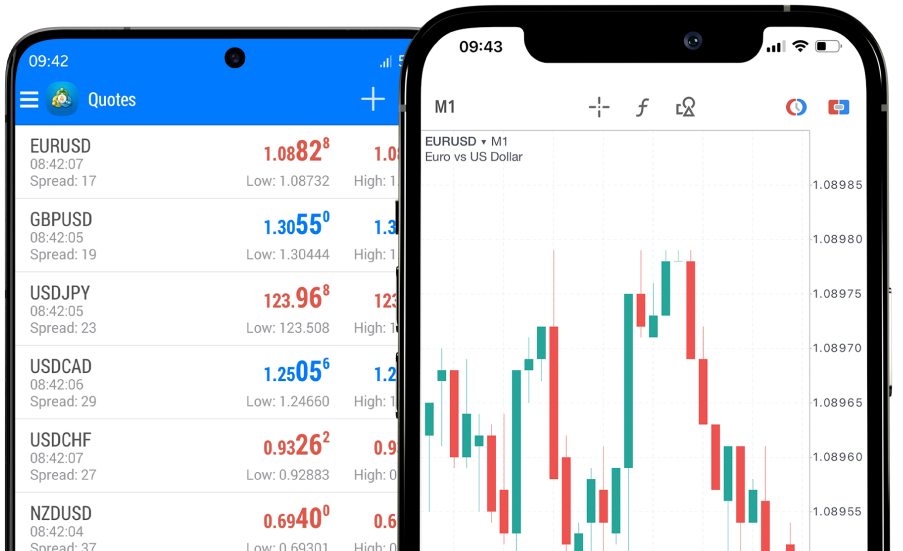

Service quality is paramount in Forex trading, where timing and information are everything. ThinkMarkets offers advanced trading technologies designed for rapid and reliable trade executions. Its proprietary platform, ThinkTrader, boasts a user-friendly interface, innovative tools, and comprehensive analytics, catering to both novice and experienced traders. The mobile app ensures traders can access the market anytime, keeping pace with the volatile Forex environment.

Customer Feedback

Customer feedback provides valuable insights into a broker's performance. ThinkMarkets has a mixed but generally positive feedback loop from its users. Traders praise its technical reliability, the breadth of educational resources, and customer support responsiveness. However, there are accounts of dissatisfaction with withdrawal times and account verification processes, common issues across many brokers that potential investors should consider.

Product Features

ThinkMarkets stands out for its diverse range of trading instruments, including Forex pairs, commodities, indices, cryptocurrencies, and more. Competitive leverage options, tight spreads, and low commission rates are key highlights, designed to enhance profitability and cater to a wide spectrum of trading strategies. Furthermore, risk management tools such as negative balance protection and stop-loss orders provide an added layer of security against the unpredictable market volatility.

Scam Alerts and Transparency

In an industry fraught with scams, transparency and honesty are invaluable. ThinkMarkets has maintained a clean record, with no significant scam alerts tarnishing its reputation. This clean bill of health is supported by its transparent trading conditions and straightforward fee structure. Nonetheless, vigilance is advised, as the landscape of online trading is constantly evolving, and regulatory compliance does not guarantee immunity from all potential risks.

Conclusion

The decision to invest with ThinkMarkets, like any broker, requires careful consideration. Its regulatory compliance, service quality, and product offerings present a compelling case for both new and experienced traders. However, the concerns raised in customer feedback highlight the importance of due diligence and setting realistic expectations regarding administrative processes.

For those considering ThinkMarkets, leveraging demo accounts and educational resources to test the platform and services is a prudent step. Engaging with the community through forums and review sites can also provide deeper insights into the broker's reliability and performance.

In the fast-paced world of Forex trading, where the stakes are high and the risks real, taking the time to think before investing is not just advisable—it's essential. ThinkMarkets, with its comprehensive suite of services and a commitment to trader success, merits consideration, but as always, informed decision-making is the key to navigating the markets successfully.