In the intricate world of online trading, selecting a reliable and efficient broker is paramount for both novice and seasoned traders. BDSwiss, a name that has consistently emerged in financial market discussions, boasts an extensive portfolio of trading services and products. This article critically evaluates BDSwiss as a broker, focusing on its regulatory compliance, trading platforms, asset offerings, customer service, fees, and educational resources to determine if it stands as a commendable choice for traders.

Regulatory Compliance and Security

A broker's credibility largely hinges on its regulatory framework and the security measures it employs to safeguard client funds. BDSwiss operates under the oversight of several regulatory bodies, including the Cyprus Securities and Exchange Commission (CySEC), the U.S. National Futures Association (NFA), and the Financial Services Authority (FSA) in Seychelles. These regulatory affiliations ensure that BDSwiss adheres to strict financial standards and operates with transparency, offering traders a level of protection and peace of mind.

Moreover, BDSwiss employs robust security measures, including SSL encryption for data transmission and segregated accounts for client funds, ensuring that traders' capital is protected from unauthorized access and insolvency risks.

Trading Platforms and Technology

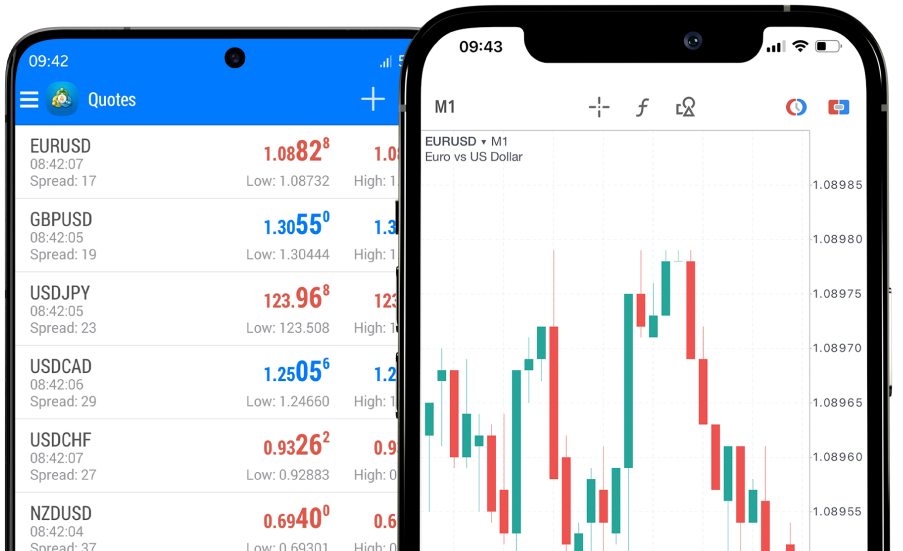

The quality of a broker's trading platforms is critical to the trading experience. BDSwiss offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are renowned for their reliability, user-friendly interfaces, and advanced trading features. These platforms cater to the needs of both beginners and experienced traders, offering a range of tools for technical analysis, automated trading through Expert Advisors (EAs), and customizable charts.

BDSwiss also provides a proprietary mobile trading app, designed to offer a seamless trading experience on the go. The app includes interactive charts, a full set of trading orders, and access to the latest financial news and analysis, making it easier for traders to manage their accounts and execute trades from anywhere.

Asset Offerings

Diversification is key to managing trading risks, and BDSwiss understands this by offering a wide range of tradable assets. Traders can access over 250 financial instruments, including forex pairs, cryptocurrencies, commodities, indices, and stocks. This extensive selection enables traders to diversify their portfolios and explore opportunities across different markets.

Customer Service

Quality customer service is indispensable in the trading environment. BDSwiss prides itself on providing responsive and helpful customer support. Traders can reach the support team via live chat, email, and phone in multiple languages, ensuring that assistance is readily available whenever needed. The responsiveness and professionalism of the customer service team are often highlighted in trader reviews, reinforcing BDSwiss's commitment to client satisfaction.

Fees and Spreads

Competitive pricing is another crucial aspect to consider when choosing a broker. BDSwiss offers competitive spreads and low trading fees, although these can vary depending on the account type. The broker provides several account types, including the Classic, VIP, and Raw accounts, each tailored to different trading strategies and volumes. While the Classic account offers wider spreads with no commission, the Raw account caters to high-volume traders with tighter spreads and a commission per trade. This flexibility allows traders to choose the pricing structure that best fits their trading style and strategy.

Educational Resources and Tools

BDSwiss places a strong emphasis on trader education and development. The broker offers an extensive array of educational resources, including webinars, seminars, eBooks, and in-depth market analysis. These resources are designed to help traders at all levels improve their trading skills and understanding of the markets. The commitment to educational support underlines BDSwiss's dedication to empowering traders to make informed decisions.

Conclusion

After a comprehensive analysis, it is evident that BDSwiss stands out as a reputable and reliable broker in the competitive world of online trading. Its regulatory compliance, advanced trading platforms, diverse asset offerings, exceptional customer service, competitive fees, and rich educational resources make it an attractive option for traders seeking a well-rounded trading experience. While no broker is without its drawbacks, BDSwiss's strengths in these critical areas demonstrate its commitment to providing a high-quality service that meets the needs of a diverse trader demographic. Therefore, BDSwiss can be considered a good broker for traders looking for a secure, versatile, and supportive trading environment.