Navigating the complex world of Forex trading requires not only skill and intuition but also a reliable trading platform that can enhance trading efficiency and profitability. IC Markets, a well-known entity in the forex market, has garnered attention for its comprehensive offerings and robust trading environment. This article delves into the various aspects of IC Markets, exploring why it stands out as a top choice for both novice and experienced traders.

Understanding IC Markets

IC Markets is a leading forex broker headquartered in Sydney, Australia, known for its high liquidity and low-latency trading environments. It provides traders with access to a wide range of financial instruments including forex, commodities, and indices. Regulated by the Australian Securities and Investments Commission (ASIC), IC Markets emphasizes transparency and customer satisfaction in its operations.

Key Features of IC Markets

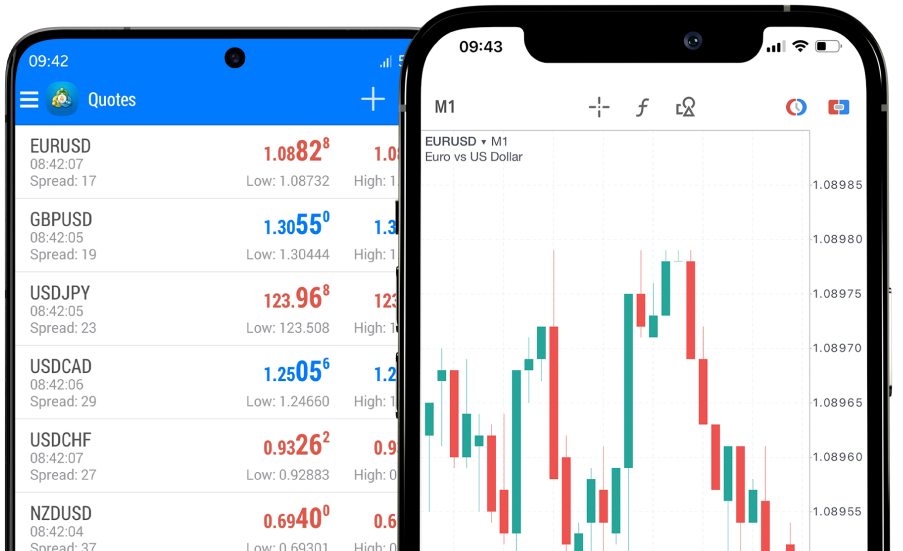

Advanced Trading Platforms: IC Markets offers MetaTrader 4, MetaTrader 5, and cTrader, which are equipped with cutting-edge trading tools and algorithms that facilitate effective trading strategies.

Competitive Spreads and Fees: Known for its tight spreads, IC Markets allows traders to maximize their profits by minimizing the costs associated with trading.

Diverse Trading Instruments: Traders can access more than 60 currency pairs, as well as CFDs on stocks, commodities, and futures, providing ample opportunities for diversification.

Industry Trends and User Feedback

The Forex trading landscape is characterized by its rapid evolution and the increasing demand for technological advancements. IC Markets has responded to these trends by integrating superior technology that caters to high-frequency traders and scalpers. Furthermore, user feedback highlights customer satisfaction particularly in areas of user-friendly interface and responsive customer service. Statistical data also suggest that IC Markets has one of the industry’s highest execution speeds, significantly reducing slippage.

Evaluating Platform Reliability and Performance

Regulatory Compliance: The credibility of IC Markets is reinforced by its compliance with several regulatory bodies, ensuring a secure trading environment for its users.

Execution Speeds and Server Reliability: IC Markets boasts state-of-the-art infrastructure that ensures fast and reliable trade executions.

Leverage Options: Offering leverage up to 1:500, IC Markets provides traders with the potential to increase their trading positions substantially, though this also increases risk.

Comparisons with Other Forex Platforms

When comparing IC Markets to its competitors, it is essential to consider various factors such as fees, range of instruments, and trading platform technologies. For instance, while IC Markets offers competitive spreads on major currency pairs, some competitors might offer lower leverage options or different account types which might be better suited for certain trading strategies.

Conclusion

IC Markets remains a formidable presence in the forex trading community due to its comprehensive offerings and commitment to trader success. Its adaptability to industry changes and responsiveness to trader needs makes it a sound choice for those looking to enhance their trading potential. As the forex market continues to grow, platforms like IC Markets will be pivotal in shaping the future of trading.