Finding the right Forex broker is a critical step for traders in Kenya looking to participate in the global currency markets. As of January 2024, the Forex landscape has evolved, and traders need up-to-date information to make informed choices. In this comprehensive guide, we will explore the 10 best Forex brokers in Kenya, taking into account factors such as regulation, trading platforms, instruments, fees, customer support, and reputation. These brokers have been chosen based on their suitability for traders in Kenya at the beginning of 2024.

1. XM

Regulation: XM is regulated by multiple authorities, including CySEC and ASIC, ensuring a high level of safety for traders.

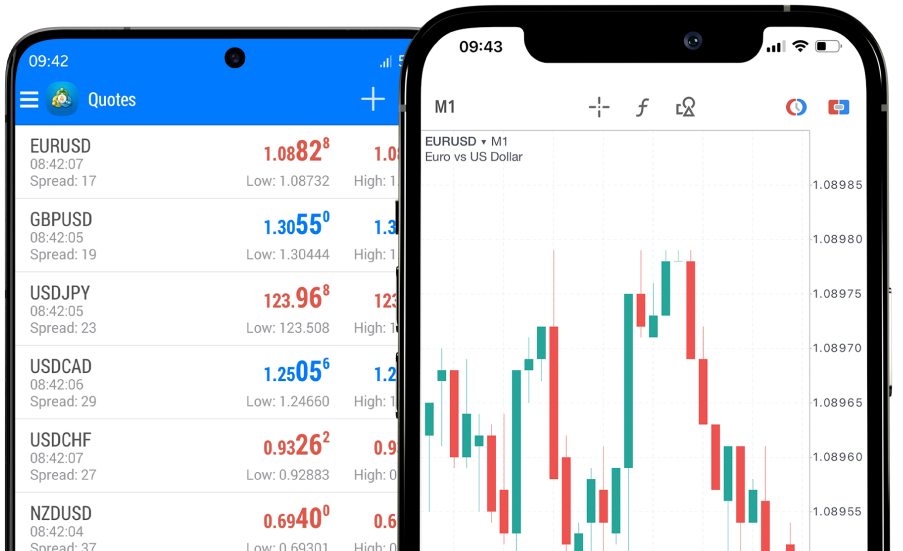

Trading Platforms: Offering both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), XM provides a versatile and reliable trading environment.

Instruments: Traders can access a wide range of currency pairs, commodities, indices, and cryptocurrencies.

Spreads and Fees: XM offers competitive spreads and a variety of account types to suit different trading styles.

Customer Support: The broker provides excellent customer support through live chat, email, and phone.

2. HotForex

Regulation: HotForex is regulated by multiple authorities, including the FSCA, ensuring a secure trading environment.

Trading Platforms: HotForex offers both MT4 and MT5, as well as its mobile app for traders on the go.

Instruments: Traders can access over 50 currency pairs, commodities, and other assets.

Spreads and Fees: HotForex offers competitive spreads and flexible account types with varying fee structures.

Customer Support: The broker provides responsive customer support and a comprehensive FAQ section.

3. FXTM (ForexTime)

Regulation: FXTM is regulated by the FSC in Mauritius and CySEC, offering a high level of regulatory oversight.

Trading Platforms: FXTM offers both MT4 and MT5, along with mobile trading options for convenience.

Instruments: Traders can access major and minor currency pairs, as well as commodities.

Spreads and Fees: FXTM provides competitive spreads and transparent fee structures.

Customer Support: The broker offers multilingual customer support through various channels.

4. OctaFX

Regulation: OctaFX is regulated by CySEC, providing a secure trading environment for traders.

Trading Platforms: OctaFX offers MT4, MT5, and cTrader platforms, catering to different trading preferences.

Instruments: Traders can access a variety of currency pairs, commodities, indices, and cryptocurrencies.

Spreads and Fees: OctaFX provides competitive spreads and low fees, making it an attractive option for traders.

Customer Support: The broker offers responsive customer support through live chat and email.

5. IG Group

Regulation: IG Group is regulated by the FCA in the UK, ensuring a high level of regulatory compliance.

Trading Platforms: IG Group offers its proprietary web-based platform and MT4 for Forex trading.

Instruments: Traders can access a wide range of assets, including Forex pairs, stocks, indices, and cryptocurrencies.

Spreads and Fees: IG Group provides competitive spreads and a transparent fee structure.

Customer Support: The broker offers customer support through live chat, email, and phone.

6. Forex.com

Regulation: Forex.com is regulated by various authorities, including the CFTC in the United States.

Trading Platforms: The broker offers its proprietary Advanced Trading Platform, along with MT4 and MT5.

Instruments: Traders can access major and minor currency pairs, commodities, and indices.

Spreads and Fees: Forex.com offers competitive spreads and transparent fee structures.

Customer Support: The broker provides customer support through live chat, email, and phone.

7. eToro

Regulation: eToro is regulated by CySEC, offering a secure environment for traders.

Trading Platforms: eToro's innovative social trading platform is known for its user-friendly interface and social networking features.

Instruments: Traders can access a variety of assets, including currencies, stocks, commodities, and cryptocurrencies.

Spreads and Fees: eToro offers competitive spreads and transparent fees.

Customer Support: The broker provides customer support through live chat and email.

8. Plus500

Regulation: Plus500 is regulated by the FCA in the UK, ensuring regulatory compliance.

Trading Platforms: Plus500 offers its proprietary trading platform, known for its simplicity and ease of use.

Instruments: Traders can access Forex pairs, stocks, commodities, and cryptocurrencies.

Spreads and Fees: Plus500 offers competitive spreads and a straightforward fee structure.

Customer Support: The broker offers customer support through email.

9. Avatrade

Regulation: Avatrade is regulated by the Central Bank of Ireland and other authorities.

Trading Platforms: Avatrade offers both MT4 and its proprietary platform, AvatradeGO.

Instruments: Traders can access a wide variety of assets, including currency pairs and commodities.

Spreads and Fees: Avatrade provides competitive spreads and transparent fee structures.

Customer Support: The broker offers customer support through live chat, email, and phone.

10. Pepperstone

Regulation: Pepperstone is regulated by ASIC and other top-tier authorities.

Trading Platforms: Pepperstone offers MT4, MT5, and cTrader platforms.

Instruments: Traders can access a variety of currency pairs, commodities, and indices.

Spreads and Fees: Pepperstone offers competitive spreads and transparent fee structures.

Customer Support: The broker provides customer support through live chat, email, and phone.

Conclusion: Making an Informed Choice

Selecting the best Forex broker in Kenya is crucial for traders aiming to navigate the Forex markets successfully. These brokers offer a range of features and cater to various trading styles. However, it's essential to consider your specific trading needs and preferences before making a final decision. Conducting thorough research and testing different brokers using demo accounts can help you find the most suitable broker for your trading journey in 2024.